Now at 2019 he sold off the property for RM800000. The government has agreed to exempt the real property gains tax RPGT to individual Malaysian citizens who dispose of their properties at a consideration price of RM20000000 and below.

Shylendra A S Nathan Sasnathan Twitter

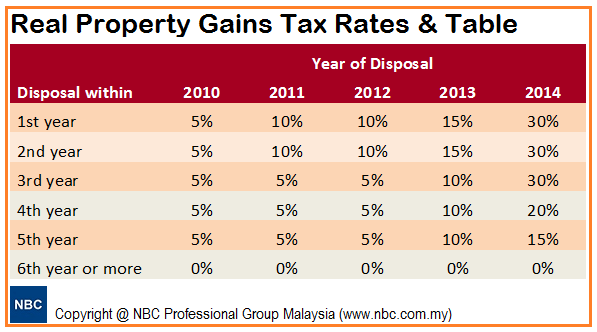

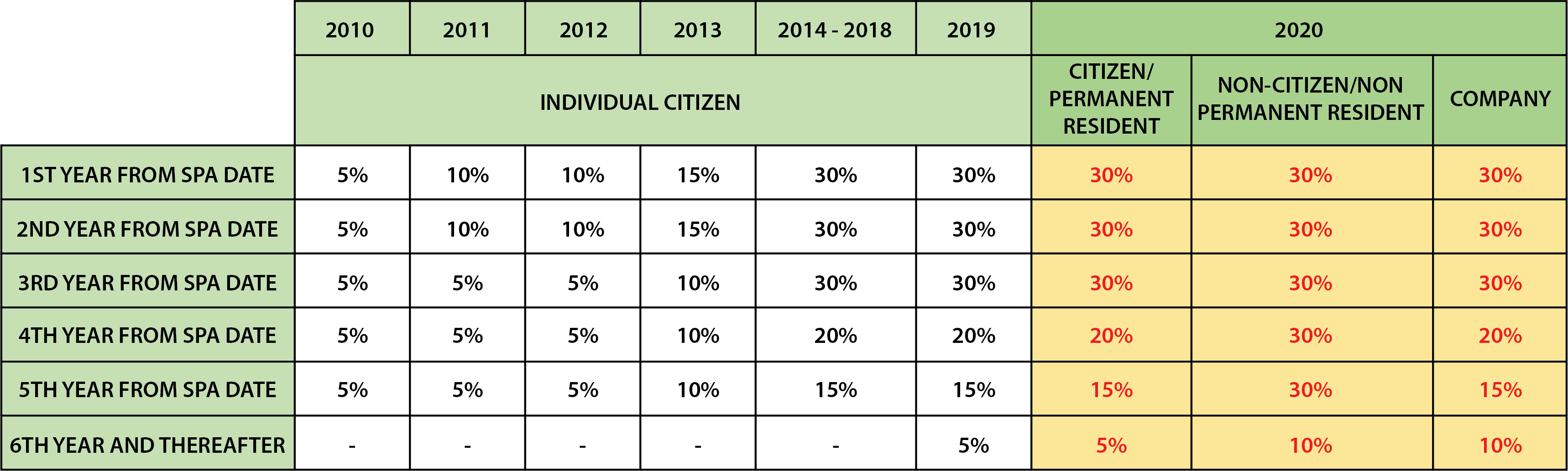

RPGT rates in Malaysia were most recently adjusted in Budget 2019 with new changes announced as part of Budget 2020.

. And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be. KUALA LUMPUR Dec 30. For example individual Malaysian citizen and partners.

In 2014 the RPGT was increased for the fifth straight year since 2009. RPGT rates differs according to disposer categories and holding period of chargeable asset. Malaysias revised Real Property Gains Tax RPGT rates that take effect from Jan 1 2019 will dampen market sentiment and sales in the near term according to industry players.

Part II Schedule 5 RPGT Act. This will help you have a better understanding of the amount that will be deducted from your profit. RPGT rates in Malaysia were adjusted in Budget 2019 with new changes announced as part of Budget 2020.

For example if you bought a house for RM250K and sell it at RM350K the profit of RM100K is chargeable under RPGT but you may be entitled to deduct expenses such as. The hike involves an additional 5 in RPGT for disposal of properties owned from 6 years and beyond as well as an increase of 1 in stamp duty for the instrument of transfer for properties exceeding RM1 million to RM25 million. It would make more sense for the government to increase the Real Property Gains Tax RPGT rates within the first five years instead of imposing a 5 tax rate for Malaysian individuals after the fifth year said the Association of Valuers Property Managers Estate Agents and Property Consultants in the Private Sector Malaysia PEPS.

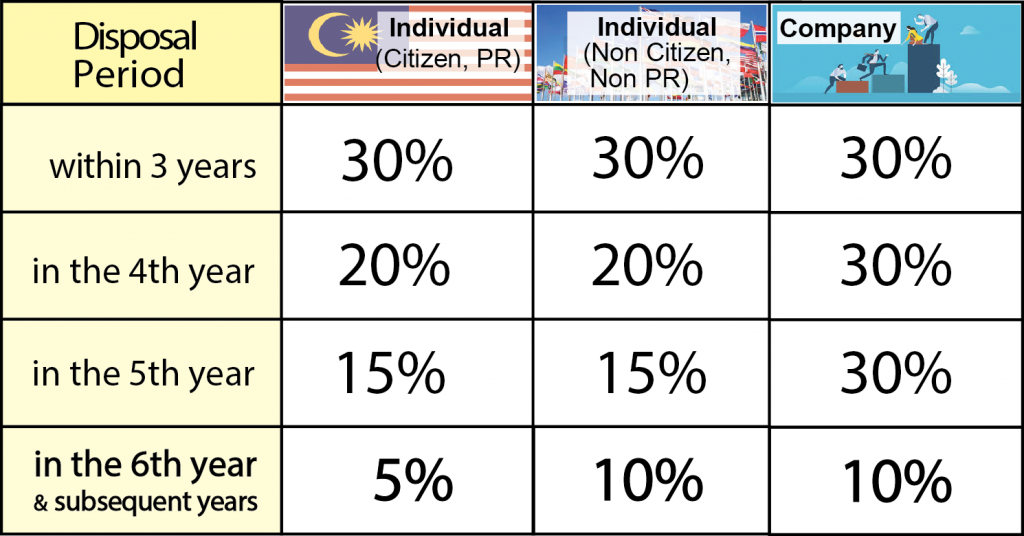

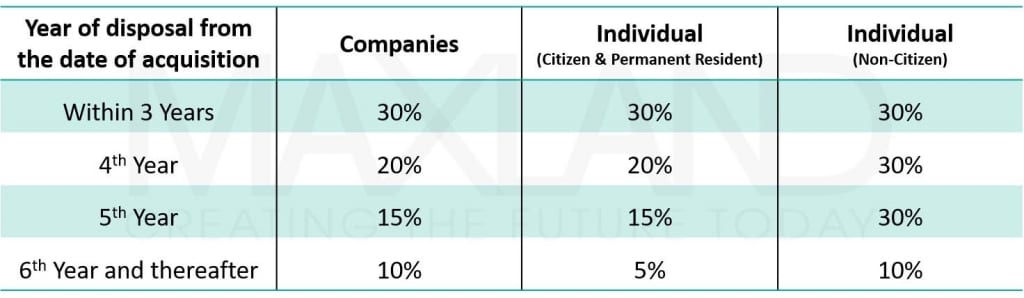

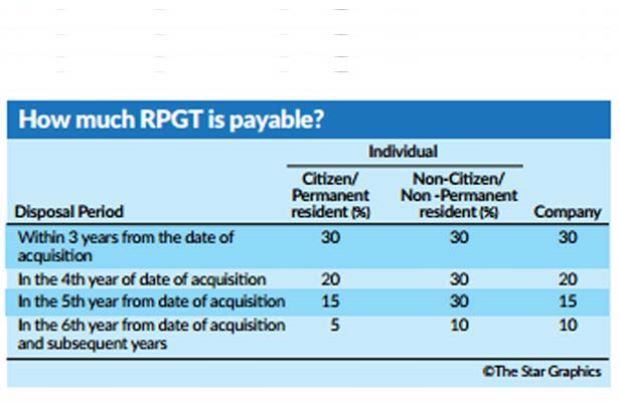

The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act. In the Budget 2019 tabled by Finance Minister Lim Guan Eng today the government proposed that the RPGT rates to be revised for disposals of properties or shares in property holding companies after the sixth year as follows. Finally calculate the total amount of RPGT you will need to pay.

Mr Tan is Malaysia Citizen. RPGT stands for Real Property Gains Tax. It is the tax which is imposed on the gains when you dispose the property in Malaysia.

RPGT Act Through The Years 1976 2022 RPGT is a tax on profit. The RPGT Calculator is a convenient way to find out the amount of tax that you need to pay after selling your property. Part 1 Schedule 5 RPGT Act.

When is RPGT applicable. Below are the RPGT rates for each of the 3 tiers for your perusal. As you can see from the above RPGT rates from the 6th year onwards have increased to twice the existing rates for all the 3 tiers.

First it was suspended temporarily from April 2007 to December 2009 and reintroduced in 2010. RPGT Payable Nett Chargeable Gain x RPGT Rate. Now here is some history about the RPGT.

Disposer is a company incorporated in Malaysia or a trustee of a trust or. For companies and foreigners the rate shall be increased from 5 to 10. The latter has been deferred for six months to July 1 2019 whereas the RPGT hike has been in effect since January 1.

The RPGT exemption effective from Jan 1 2019 were for the disposal of properties including low-cost houses low-medium cost houses and affordable houses from. REAL PROPERTY GAINS TAX FOR 2013. November 2 2018.

Earlier this year the government once again revised RPGT rates giving tax exemptions to low-cost and budget homes below RM200000 while increasing the tax rate to 5 for properties held by Malaysian citizens for more than five years. He bought a property 10 years ago for RM500000. 2 Non-citizens and non-permanent residents and companies not incorporated in Malaysia 3 - Society registered under the Societies Act 1966 wef 1 January 2022 consists of body of persons registered under any written law in Malaysia 4 - RPGT rates for disposals made in the 6th year and subsequent years reduced to 0 wef.

You will get the results in a shorter amount of time instead of having to do the research and calculations by yourself. RPGT to pay RPGT Tax Rate disposal of property based on holding period x Net Chargeable Gain. Before and during the selling process he.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. The most recent RPGT amendment to be implemented in 2019 will be the seventh one so far. Under the recent Budget 2022 Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens and permanent residents starting from the sixth yearThis means that the RPGT rate for property disposals in the 6th year and subsequent years after the.

That means it is payable by the seller of a property when the resale price is higher than the purchase price. According to a statement by Finance Minister Lim Guan Eng today the RPGT exemption effective from Jan 1 2019 are for the disposal of properties including low. In 2019 the RPGT rates have been revised.

The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. New RPGT Rates from 1 January 2019. Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order.

And for Malaysian individuals the rate shall. Except part II and part III. The government has agreed to exempt the real property gains tax RPGT to Malaysian citizens who dispose of their properties at a consideration price of RM200000 and below.

The most recent RPGT amendments in lieu of our Budget 2019 announced by Ministry of Finance MOF Malaysians who are selling off their property in the sixth and subsequent years of ownership will now have to pay a 5 RPGT. During the Budget 2012 the Finance Minister proposed to revise Real Property Gains Tax RPGT rate as.

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

All About Rpgt Real Property Gain Tax 2019 My Awesome Property

Understanding Rpgt 2 Real Property Companies Legally Malaysians

Real Property Gains Tax Rpgt Exemptions In Malaysia 2021 Maxland Real Estate Agency

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

What Is Real Property Gains Tax In Malaysia Asianewsnetwork Eleven Media Group Co Ltd

Bernama Real Property Gains Tax Rpgt

What Is Rpgt Dpi Media Des Prix Infinitus Media

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

How The New Rpgt Ruling Is Affecting The Rakyat

Guide To Malaysian Real Property Gain Tax Rpgt

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important